The 3 most important level 1 CFA exam topics are:

- Financial Statement Analysis (FSA)*,

- Ethical and Professional Standards (Ethics),

- Quantitative Methods (QM).

Below you can see the details for the most important 2024 level 1 CFA exam topics. There are some important changes for level 1 CFA exam topics in 2024, including new topic weights or a new number of learning modules. See all 2024 level 1 CFA exam topics here.

Both FSA (or FRA) and Ethics are given the highest topic weight in the level 1 CFA exam, i.e. 15-20% and 11-14%, respectively. This means that you'll have to answer the most questions for these two topics. In your computer-based level 1 exam, you may probably expect around 33 questions for Ethics and even 25 for FSA.

Quantitative Methods are given 6-9%. If you take a quick look at the table illustrating all the topics, you'll see that Equity and Fixed Income are given the same exam weight as FSA, which is higher than for QM. However, no other topic – and surely neither EI nor FI – is referred to as often as QM when you study for your CFA exam. That's why we count Quantitative Methods among the 3 most important level 1 topics.

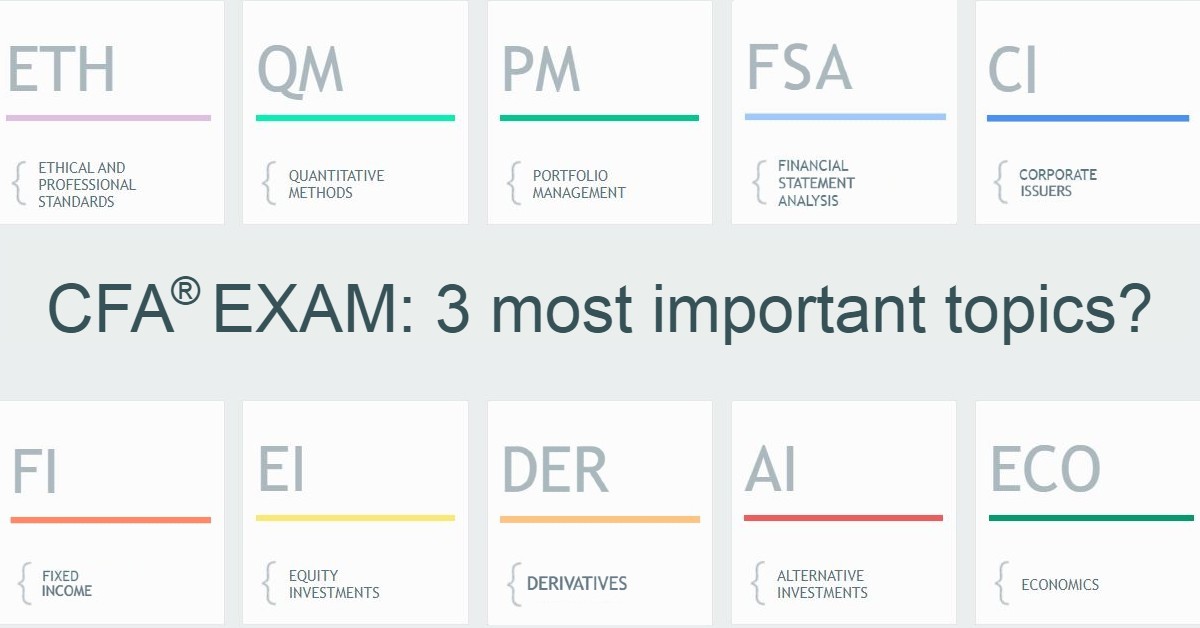

Important Level 1 CFA Exam Topics

| Level 1 CFA Exam Topic | Short Description | 2024 Topic Weight | No. of Modules in 2024 |

No. of Formulas | Predicted No. of Questions |

|---|---|---|---|---|---|

| Ethics | Moral spine vs investment environment | 15-20% | 5 | None, which is an exception! | ca. 33 |

| Financial Statement Analysis* | Financial statements + Accounting methods + Reporting standards | 11-14% | 12 | around 50 | ca. 25 |

| Quantitative Methods | Many quantitative concepts & tools | 6-9% | 11 | around 50 | ca. 16 |

* Before 2022, the CFA Program curriculum referred to Financial Statement Analysis as Financial Reporting and Analysis (FRA for short).

A learning module is a new name for what used to be called reading. It's a change partially introduced to the level 1 CFA exam curriculum in 2023, mainly in nomenclature but not only. The idea is for the learning modules to form digestive lessons that can be studied over one sitting. In your 2024 syllabus, you'll find all of the level 1 topics divided into learning modules (LM).

We elaborate more on our top trio, including Quantitative Methods, below. In this post, you'll also find free presentations summarizing Quantitative Methods and Ethics

Super Important FSA (or FRA)

That the topic of Financial Statement Analysis (aka. Financial Reporting & Analysis, FRA) is important is the least to say. It’s super important! As many as 20 to 25 out of 180 exam questions for level 1 2024 CFA exams are going to be FSA questions.

That is why no effort spared on FSA is lost. The better you cope with the topic now, the bigger the chances of success in your level 1 exam. Plus, it will surely pay off when the challenges of the level 2 exam get real because Financial Statement Analysis is one of the topics given greater importance in the level 2 exam.

The focus of the level 1 exam is on knowledge and comprehension, while for level 2 – it’s application and analysis. You can really experience that when studying FSA. At level 1, you’re asked to acquire lots of terms and to understand what FSA is all about, and – at level 2 – you are required to be able to analyze and evaluate what you see.

And that’s it.

There’s nothing more at level 3.

Perhaps that’s the reason why FSA is given such an emphasis both at level 1 and level 2 of the CFA exam. You have to develop all the competencies necessary for the analysis and reporting of financial statements already when studying for the first two exams.

These competencies are crucial not only in the context of the CFA exam but also when you think about your future. Many different kinds of jobs require the ability to read and analyze financial statements. You can be very skillful with Excel spreadsheets. You can handle the time-value-of-money (TVM) problems easily. You can know how to value companies using various methods. But if you can't interpret these companies’ financial reports, you won’t be able to apply all your other skills where they really matter – in practice. They will be just theoretical.

And you don’t want that as a CFA charterholder-to-be.

After all, the CFA designation is a credential certifying that you possess professional expertise, including analytical proficiency.

Ethics Matters Much

The professional expertise you’ll gain as a CFA charterholder will also relate to ethical conduct.

There’s a strong emphasis put on Ethics, which you probably already know. So, it comes as no surprise that as many as 15-20% of level 1 exam questions are devoted to Ethics.

Ethics questions usually take the form of cases related in one way or another to the CFA Institute Code of Ethics and 7 Standards of Professional Conduct. In that sense, they stand out from other exam questions. As a rule, Ethics cases describe various situations likely to happen in an investment environment and make you react to the situation by asking to provide the correct answer.

When studying Ethics, you should pay enough attention to Ethics cases and their descriptions!

You will need a lot of practice to become fluent in diagnosing possible violations. So, analyze all the cases meant as an illustration of separate standards in your CFA exam curriculum. Also, you can find many Ethics cases inside our Study Planner. They are exam-type questions that ask about viable ethical problems and then provide an explanation. A thorough study of sample cases will make you alert to possible violations and able to respond to them in a strictly determined manner compliant with the Code and Standards – not only in the exam but also in life.

This brings us to why Ethics matters so much.

A universal approach based on some commonly accepted moral standards is simply a must in an industry that operates on both local and global scales and which is all about money. The nature of the financial industry makes it too vulnerable to be left just to national legislation. Only adherence to some shared rules and values can guarantee proper conduct towards economies, companies, and individual investors worldwide.

That is why Ethical and Professional Standards are very important at all levels of the CFA exam. The essence stays the same and it’s the Code and Standards as shown in the free presentation below:

This presentation makes a great intro to Ethics but it can also serve as a comprehensive recap (or both ) depending on the strategy you’ll apply for Ethics.

CFA exam candidates usually study Ethics by:

- reading it once: just before the exam, or

- reading it twice: at the beginning of the exam prep + revision just before the exam.

Regardless of the strategy, the goal is always the same to remember things better in the exam!

However, the result can be just the opposite, particularly for the read-once-only strategy. In this sense, the second technique is much better because you give yourself a chance to understand what you previously read about.

Regardless of the technique you choose, we definitely recommend that you find some time to review the Code of Ethics and Standards of Professional Conduct after you read them. Revision is what makes the difference!

When you study your Ethics – whether at the beginning, in the middle, or at the end of your prep – is really up to you. That is why when you set up your CFA exam study plan, you can easily choose your preferred topic sequence using drag&drop for topics in the PLAN view of your Study Plan. Remember one thing, though! Devoting enough study time to Ethics is definitely worth it because Ethics is so important to CFA Institute. It’s the only topic given special treatment thanks to introducing the so-called ethics adjustment. This principle has been set by CFA Institute to discriminate between the borderline cases: who should be given a pass and who should be given a fail.

Quantitative Methods and QM-Related Topics

The major areas covered in the level 1 Quantitative Methods topic include rates and returns, time value of money, basics of probability, descriptive statistics, statistical interference (with estimation and hypothesis testing), linear regression, as well as fintech and big data (moved in 2024 to QM from PM).

Here are the 11 learning modules you will find in your 2024 level 1 CFA exam syllabus for the Quantitative Methods topic:

- RATES & RETURNS

- TVM IN FINANCE

- STATISTICAL MEASURES

- PROBABILITY TREES & CONDITIONAL EXPECTATIONS

- PORTFOLIO MATHEMATICS

- SIMULATION METHODS

- ESTIMATION & INFERENCE

- HYPOTHESIS TESTING

- TESTS OF INDEPENDENCE

- LINEAR REGRESSION

- FINTECH & BIG DATA

You will find numerous quantitative tools there which are also used in other level 1 topics. Some of the tools that QM shares with other topics are:

- time value of money Corporate Issuers, Equity Investments, Fixed Income, FSA, Derivatives,

- measures of interest rates, dispersion, and covariance Portfolio Management,

- probability tree Derivatives.

That's exactly why Quantitative Methods are considered an important level 1 topic.

The more proficient you are in QM, the better you’ll get at other related topics. (Note that becoming proficient in QM also includes getting skillful with your calculator and being flexible with using formulas).

2 Remarks on Level 1 Quantitative Methods:

/1 : QM is one of the hardest topics in the level 2 exam.

- It’s mainly devoted to statistics (hypothesis testing, regression, trend analysis), which makes it obvious how important this part of the QM topic should be for you also in the level 1 exam.

/2 : When getting trained with calculations, opt for the calculator approved by CFA Institute (read about CFA exam calculators).

- Do not use Excel or any other calculators. Focus on the right way of handling calculations from the very beginning of your CFA exam prep.

- In our videos, you can see how to use different calculator worksheets. Apart from the commonly applied TVM and CF+NPV+IRR, we also show DATA+STAT worksheets useful in dealing with descriptive statistics problems.

Recommended course of action:

Owing to the many quantitative tools that overlap with different topics, we suggest that you make Quantitative Methods the first mathematical topic you study. That should make the absorption of other topics so much easier and ensure a thorough understanding of QM concepts. How is that? Because while studying other topics, you get to recall various QM concepts.

In our CFA exam study planner, we practice what we preach. If you follow our recommended topic sequence, you’ll get to study QM first, shortly before PM or CI. But you'll also be able to easily change the topic sequence to your liking. To set up your free study schedule, click this button:

Find 220+ LVL 1 STUDY LESSONS INSIDE!

Before you go, see our free presentation about the time value of money and the basics of statistics:

About Soleadea:

Our CFA Exam Study Planner is available to candidates of all levels at groundbreaking Pay-What-You-Can prices. You decide how much you want to pay for our services. After you activate your account, you get unlimited access to our Study Planner 4.0 with study lessons inside, various level 1/level 2 study materials & tools, regular review sessions, and a holistic growth approach to your preparation. Join

Read Also: